Maximum 403 B Contribution 2024 Employer Match

Maximum 403 B Contribution 2024 Employer Match. Defined benefit plan benefit limits. The 403b contribution limits for 2024 are:

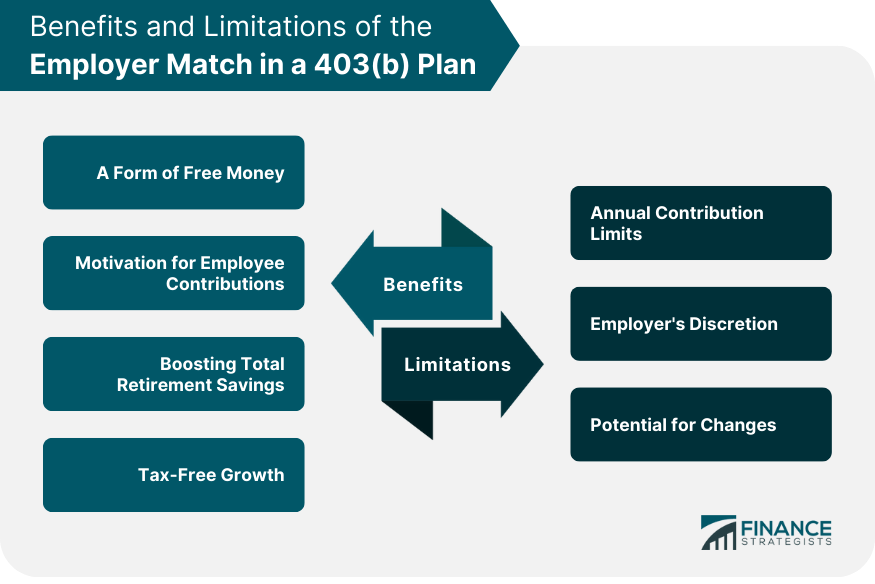

Defined benefit plan benefit limits. The exact amount of the match will vary from employer to employer, but you may receive a match of 100 percent on your first two percent of contributions and 50 percent on the next three.

403 (B) Employer Match Limit.

This is the limit across all 403 (b) accounts, whether you change employers or have both a roth and traditional 403 (b).

Whether Or Not You Are A Business Owner May Affect How Much You Can Contribute.

The exact amount of the match will vary from employer to employer, but you may receive a match of 100 percent on your first two percent of contributions and 50 percent on the next three.

Updated On January 18, 2024.

Images References :

Source: www.financestrategists.com

Source: www.financestrategists.com

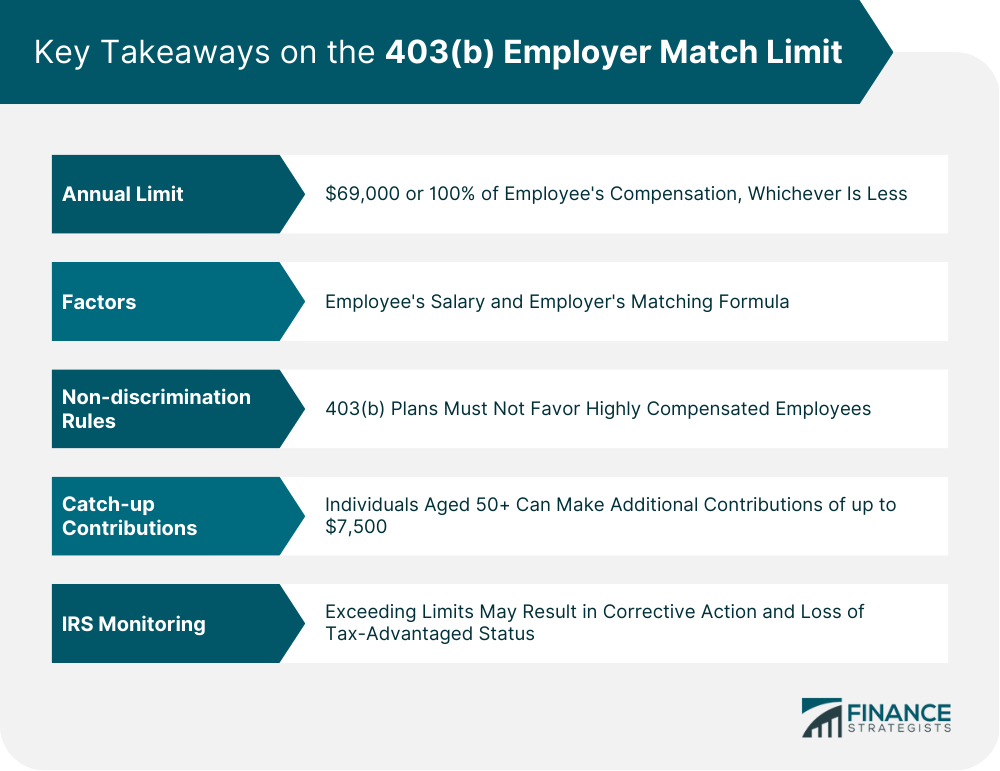

403(b) Employer Match Limit Finance Strategists, Under this year’s maximum limits, the total of your elective deferrals and your employer’s matched contributions cannot exceed $69,000. Your total combined employee and employer match contribution limit is $66,000.

Source: www.financestrategists.com

Source: www.financestrategists.com

403(b) Employer Match Limit Finance Strategists, Defined benefit plan benefit limits. Discretionary or matching contributions from employers are permitted, up to a total combined maximum of $69,000 in employer and employee contributions for those younger than 50 in.

Source: editheqcharmain.pages.dev

Source: editheqcharmain.pages.dev

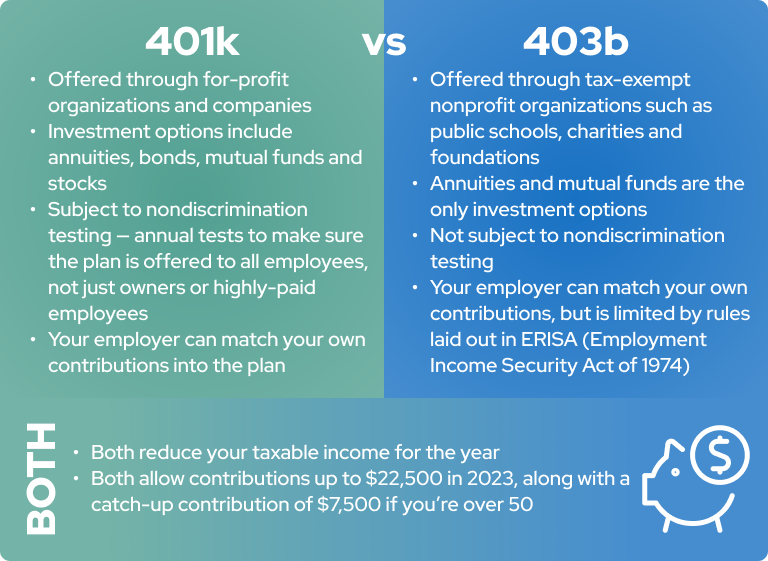

Max 403b Contribution 2024 Jeanne Maudie, This is the total amount that you can contribute to your 403 (b) plan from your salary before taxes. Here's how the 401 (k) plan limits will change in 2024:

Source: www.msn.com

Source: www.msn.com

403(b) Contribution Limits for 2024, $69,000 (was $66,000 in 2023) Because they are indexed for inflation, these limits may change annually or periodically in order to remain in line with the economy.

Source: jerrileewkorry.pages.dev

Source: jerrileewkorry.pages.dev

401k Contribution Limits 2024 Fidelity Athena Aloisia, Number of years with your current employer: This is the limit across all 403 (b) accounts, whether you change employers or have both a roth and traditional 403 (b).

Source: www.advantaira.com

Source: www.advantaira.com

2024 Contribution Limits Announced by the IRS, On your end, you can defer up to $23,000 from your salary to your 403(b) in 2024. For those with a 401 (k), 403 (b), or 457 plan through an employer, your new maximum contribution limit will go up to

Source: www.retireguide.com

Source: www.retireguide.com

403(b) Retirement Plans TaxSheltered Annuity Plans, This is the total amount that you can contribute to your 403 (b) plan from your salary before taxes. The 2023annual limit for an employer’s 401(k) match plus elective deferrals is 100% of your annual compensation or $66,000,.

Source: gwenoreweleen.pages.dev

Source: gwenoreweleen.pages.dev

What Is The Maximum Contribution To An Ira In 2024 Fleur Leland, In 2024, this limit stands at $23,000, an increase from $22,500 in 2023. Because they are indexed for inflation, these limits may change annually or periodically in order to remain in line with the economy.

Source: www.howtoquick.net

Source: www.howtoquick.net

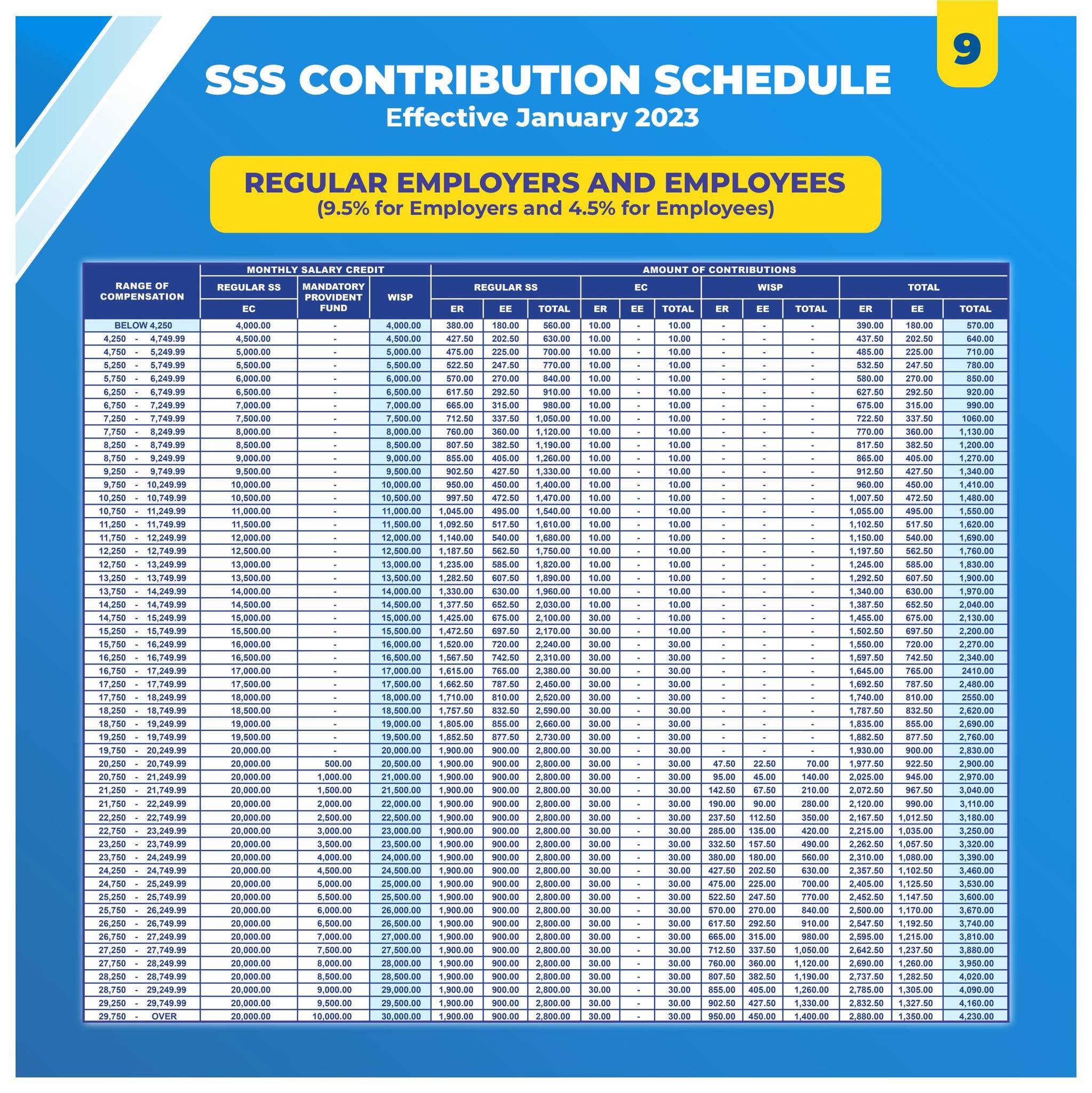

New SSS Contribution Table 2024 Schedule Effective January, Because they are indexed for inflation, these limits may change annually or periodically in order to remain in line with the economy. $69,000 in 2024 ($66,000 for 2023;

Source: potomacfund.com

Source: potomacfund.com

What is a 403(b) Account? (and how to make yours better) Potomac, The 2023annual limit for an employer’s 401(k) match plus elective deferrals is 100% of your annual compensation or $66,000,. Your total combined employee and employer match contribution limit is $66,000.

The Contribution Limit For 403 (B) Plans Is $23,000 In 2024 For Workers Under Age 50, Up $500 From $22,500 In 2023.

The limit on annual additions (the combination of all employer contributions and employee elective salary deferrals to all 403 (b) accounts) generally is the lesser of:

The Exact Amount Of The Match Will Vary From Employer To Employer, But You May Receive A Match Of 100 Percent On Your First Two Percent Of Contributions And 50 Percent On The Next Three.

Your years of employment help determine the maximum amount you will be eligible to contribute.